do nonprofits pay taxes in california

N umerous nonprofit devout organizations are excluded from government and state wage assess. Generally a nonprofits sales and purchases are taxable.

Advising California Nonprofit Corporations Legal Practice Guide Ceb

Although sales tax can be passed on to customers who buy goods an organization is responsible for paying it unless it fits within one of the states specific exceptions.

. Many nonprofit and religious organizations are exempt from federal and state income tax. N onprofit pay sales tax in California. The Welfare Exemption was first adopted by voters as a constitutional.

Select Register for Employer Payroll Tax Account Number. California Payroll Taxes. Sole proprietorships general partnerships and tax-exempt nonprofits are not required to pay this tax.

But theres no comparable wide exclusion from deals and utilize charge in places like California. Complete the online registration application. Exempt Organization Annual Information Return Form 199 11.

Check your account status. Log in to e-Services for Business. If your nonprofit organization owns or leases property this presentation will be beneficial to you.

Refer to the Information Sheet. But did you know that nonprofit organizations that qualify for federal tax-exempt status are by law also exempt from paying property taxes. You will have to file Form 990T and pay 4200 21 in.

Late last week a new bill that would eliminate California Franchise Tax Board FTB filing fees for non-profit organizations was introduced to the Senate. California System of Experience Rating DE 231Z PDF for more information on the experience rating method. Since the national average for nonprofits is more than twice the amount in taxes for every dollar paid in claims most 501c3s save money by becoming reimbursing employers.

Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered by the Board of Equalization and county assessors offices in California. If you do not verify your email address within 24 hours you will need to restart the enrollment process. The California Legislature has the authority to exempt property 1 used exclusively for religious hospital or charitable purposes and 2 owned or held in trust by nonprofit organizations operating for those purposes.

By Michele Berger Category. If you have a charity or nonprofit you may qualify for tax exemption. In California depending upon ownership and use of the property eligible nonprofit organizations may separately apply and receive an exemption from local property taxes.

In the State of California this exemption is known as the Welfare Exemption. By and large a. The State Constitution authorizes the Legislature to exempt certain property including property owned by charitable nonprofits.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Generally a nonprofits sales and purchases are taxable. Nonprofits Exempt From Ad Valorem Property Taxes.

24 Feb 2020 141 pm. A nonprofit entity can either. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax.

Exempt Organizations Business Income Tax Return Form 109 13. Pay the same UI taxes as those paid by commercial employers experience rating method. This exemption known as the Welfare Exemption is available to qualifying organizations that have income-tax-exempt status under.

California e-Postcard FTB 199N 12. It is common knowledge that nonprofit organizations generally do not pay income tax. This exemption is known as the Welfare Exemption and was first adopted by voters as a constitutional amendment on November 7.

While there is no general sales tax exclusion for nonprofit organizations certain types of organizations are eligible for specific tax exemptions and exclusions. Find out if your account with us is active or suspended. Your organization must apply to get tax-exempt status from us.

Use the tables to determine your organizations filing requirement for the following forms. January 23 2017. But there is no similar broad exemption from sales and use tax in places like California.

For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their regular charitable functions and activities. Property Tax Exemption Information for Nonprofit Organizations. One human service agency in California with a gross annual payroll of 16 million has an unemployment tax rate of 48 percent.

Nonprofits exempt under 501 c 3 of the Internal Revenue Code are not automatically exempt from property taxes. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. Tax-exempt status means your organization will not pay tax on certain nonprofit income.

2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections 7405. All California property is subject to the property tax unless exempted. As a whole nonprofit organizations must pay Unemployment Insurance State Disability Insurance Employment Training Tax and Personal Income Tax withholdings.

Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. If your nonprofit spends lets say 20000 per year in such employee benefits then you must report 20000 as unrelated business income and pay 21 taxes on it UBIT Unrelated Business Income Tax. At the time of publication the yearly California franchise tax is 800 for all noncorporate entities subject to the tax.

Its state unemployment insurance taxes are more. 501c3 exempt organizations however have choices when it comes to the payment of unemployment costs. In other words nonprofit and religious organizations in general are treated just like other California sellers and.

Nonprofits Exempt From Ad Valorem Property Taxes. A nonprofit subject to 501c3 of the Internal Revenue Code is not automatically exempt from property taxes on its property. Corporation Franchise or Income Tax Return Form 100 14.

For corporations the 800 figure is the minimum franchise tax due. Most Property Is Subject to the Property Tax. How to Pay the Franchise Tax in California.

Senate Bill 934 introduced by Senator Patricia Bates R-Laguna Niguel would get rid of the current 25 filing fee for non-profit organizations looking for a tax exemption starting in 2021. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods.

Church Law Center What Tax Exempt Means For California Nonprofits Church Law Center

California Nonprofit Corporation 501 C 3 A People S Choice

You May Not Want To Hear How Much Money You Have To Make To Live In Colorado Map 30 Year Mortgage Usa Map

Ca Sales And Use Tax Guidance For Not For Profits

How To Start A Nonprofit In California 501c3 Truic

Ca Sales And Use Tax Guidance For Not For Profits

Applying For The California Property Tax Welfare Exemption An Overview Nonprofit Law Blog

California Property Tax Exemption Must Primarily Benefit Californians Nonprofit Law Blog

California Seals California Tehama County California Tattoo

California Ftb Update For Nonprofits Nonprofit Law Blog

Https Irsprob Com Irsprob Com Wins Again 2 Internal Revenue Service Cpa Irs

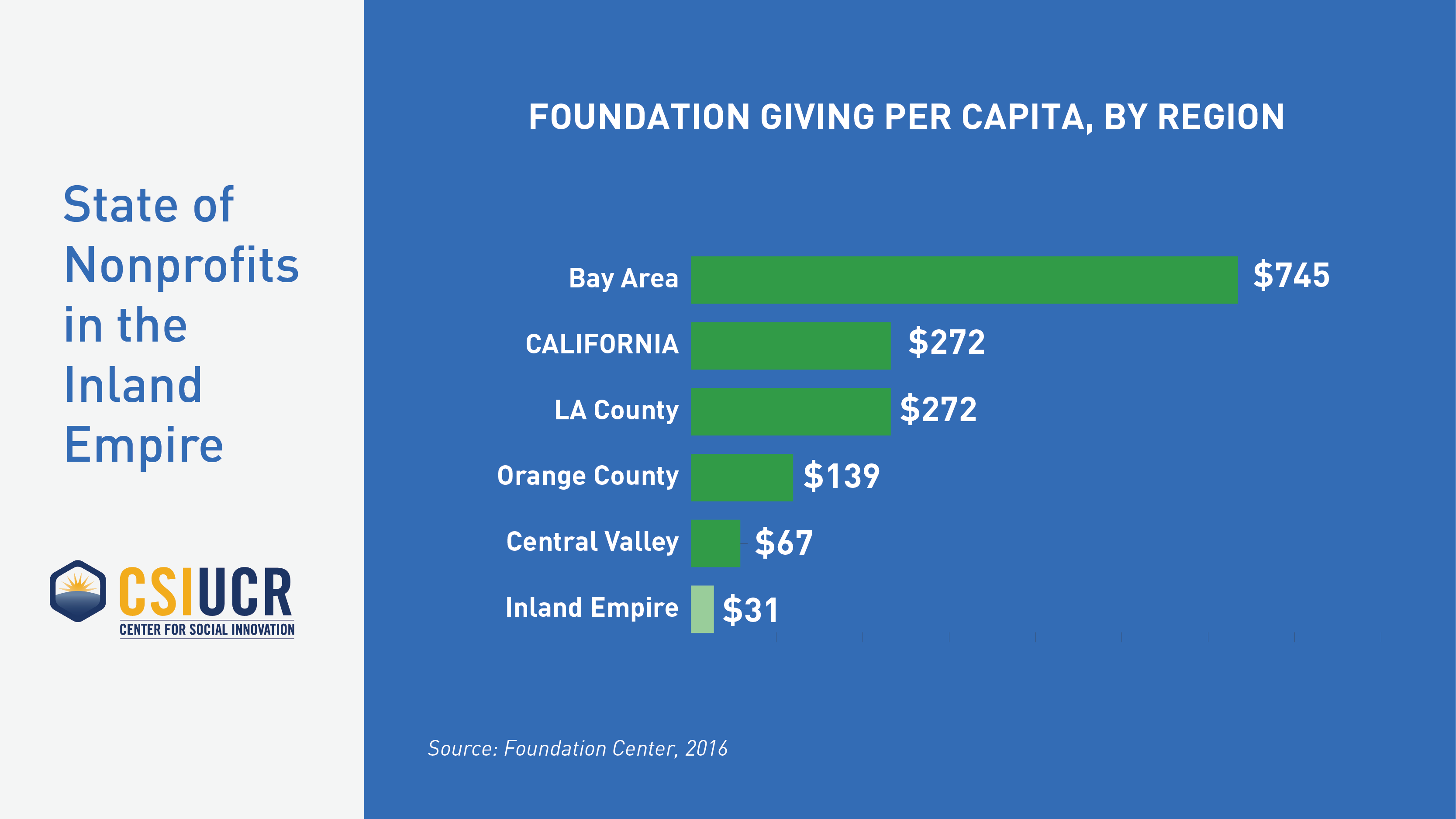

State Of Nonprofits In The Inland Empire Center For Social Innovation

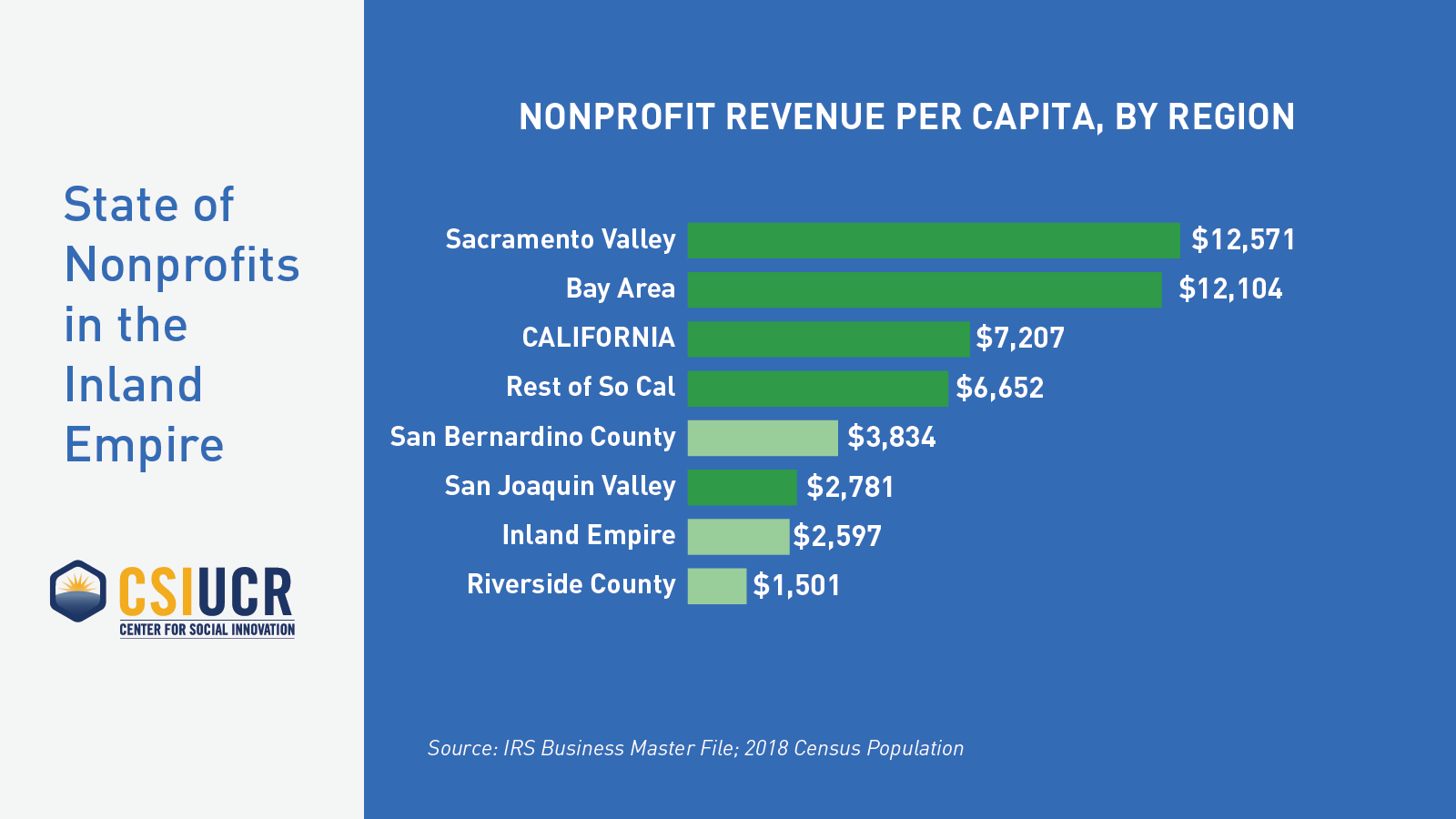

State Of Nonprofits In The Inland Empire Center For Social Innovation

Slo How It Was For About 10 000 Years Beautiful Still San Luis Obispo County Native American Culture Native American Peoples

Bill Would Strip Tax Exempt Status For Engaging In Insurrection Abc10 Com